In her 1970s song Big Yellow Taxi, Joni Mitchell sings “…don't it always seem to go, that you don't know what you got till it's gone”. This line summarises the impact of telecom companies quite nicely. We are so used to being almost permanently online that we don’t really appreciate what we have and do not really know what to do when we’re not. But behind this what we have come to consider as a basic need obviously lies an enormous infrastructure of hard- and software that keeps us connected. And it’s telecom companies that provide this basic service. In this article we discuss the value of telecom companies from an impact-risk-return perspective; how they contribute to our transition themes and why it could make sense to invest in them.

Cohesion and social empowerment

The societal transition is one of five interlinked transitions for the transformation that needs to happen to achieve our vision for a prosperous life for people on a thriving planet. We aim to enable and accelerate these vital transitions by investing in companies that contribute to one or more of our five transitions. Telecom companies primarily contribute to the societal transition by facilitating access to key products, services, and markets that broaden opportunities for marginalised groups and individuals to participate in cultural, political and social spaces. Their positive impact shows in several ways.

The key service of telecom companies is connectivity. They connect us with each other and the world around us through broadband internet, mobile phones, TV and so on, thus providing basic services. Another example is the material improvement in their personal financial situation, which enhances their possibilities to participate, when people upgrade from a 3G phone to a very affordable 4G smartphone, as research from Safaricom shows.

A critic could argue that in developed markets, the value derived from connectivity is lower. This is because alleviation from poverty is mainly relevant for emerging markets. Without reliable telecom infrastructure, however, the pandemic would have been very different for all of us. We would not have been able to connect with others, work from home or receive education. Established telecom operators such as KPN also play an important role in the adoption of new technologies by everyone in society. A good example of this, is KPN’s contribution to the annual Girl’s Day. This event aims to introduce girls to work in the technology sector, one of the least diverse sectors to work in.

A third example is Latin American telecom company Millicom has a specific program focused on closing the digital gender gap. The program is called Conectadas and provides women with training to use connectivity for their personal development. Since its beginning in 2017, close to a million women and girls have participated in this program.

These three examples clearly demonstrate the important role telecom companies play in our society by enhancing inclusion and empowerment and thus how they contribute to the societal transition.

Telecom in an equity portfolio

Their impact case is clear. But why do telecom companies deserve a place in an equity portfolio? Here we need to distinguish between telecom companies operating in developed and emerging markets.

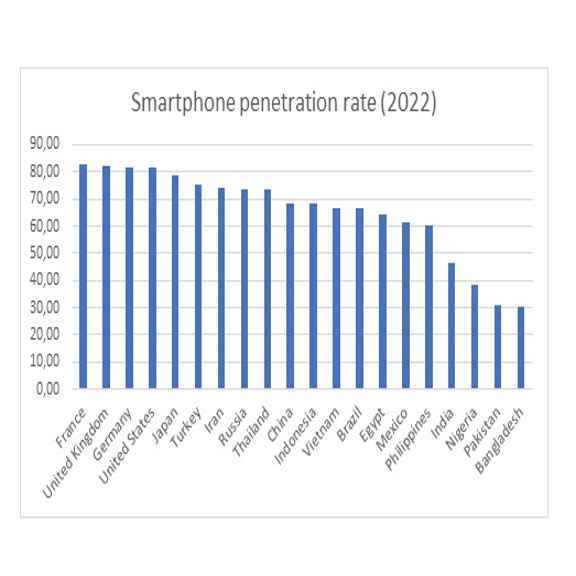

The graph below shows that in emerging market smartphone penetration is much lower than in developed markets.

Because of this, companies invest to grow their subscriber base in emerging markets. In developed markets, on the other hand, they are more focused on maintaining their subscriber base. As a result, developed market telecom companies tend to grow a bit slower versus their emerging market peers. The positive side of this is that they are therefore more stable and predictable, as they generate most of their revenues from subscriptions. They also tend to offer an attractive dividend yield (for KPN for example this is currently around 5%). Finally, the fundamentals of telecom companies are improving because the need to invest in networks is diminishing, as they are quite up-to-date. This improves their cash flow generation, which is generally positive for equity investments. As a result, while shares of telecom companies in developed markets are generally considered defensive investments, they now also come with some catalysts that could lead to higher valuations.

The story is a little different for emerging market telecom companies. They grow faster, but typically they come with more risks such as from currencies and politics. As such these are generally not considered defensive equity investments. However, emerging markets have skipped various legacy technologies, which causes the mobile phone to often be the first (and possibly only) device that’s used for connectivity. This has enabled telecom operators to develop much more services around a mobile phone subscription. For example, Safaricom is also generating a substantial amount of revenue from payments, through its M-Pesa service. So, emerging markets telecom companies are riskier, but they tend to grow much faster as they have multiple growth drivers for revenue.

Clear impact

Big Yellow Taxi is a protest song about the loss of nature and therefore, alas, still very relevant today. There are plenty of songs about phones, but none about telecom companies and the blessings of their products and services. Yet, we believe their impact on society is underappreciated and they deserve a place in a diversified impact equity portfolio.