The historical context of ESG

"To understand the ESG backlash, we need to look back at how ESG emerged," Triodos economist Joeri de Wilde kicks off the discussion. “The term ESG first gained mainstream traction in a 2004 UN report, which coincided with increasing scientific evidence pointing to the need for sustainable practices to avoid crossing planetary boundaries. From 2020 to 2022, the number of companies and countries committing to net-zero goals surged, reflecting a growing alignment of managed assets with sustainability objectives.”

However, this rapid growth began to challenge vested interests within the fossil fuel industry, explains De Wilde. ”A pivotal moment where oil executives in Texas complained about losing access to loans from major banks like JP Morgan. This incident catalysed a movement among conservative lawmakers and think tanks against ESG investing, framing it as 'woke' investing.”

Consequences of the backlash

Lewis Johnston, director of policy at ShareAction, highlights the consequences of this backlash, which are evident across various jurisdictions, particularly in the US and Europe. "In many ways, we are victims of our own success," he remarks, referring to the significant victories achieved in the sustainable investment space over the past decade. However, the backlash manifests itself in tangible changes in investor behaviour and regulatory landscapes.

Johnston points to recent high-profile departures from voluntary initiatives, such as the Net Zero Banking Alliance, primarily concentrated in North America. "We've seen discussions about whether the standards of these initiatives need to be softened," he said, indicating a potential loosening of climate commitments. “This chilling effect has also led to a fear of litigation among investors, discouraging them from engaging in stewardship initiatives.”

Across the Atlantic, Johnston observes a worrying trend in the European Union, where recent proposals threaten to roll back significant regulatory progress achieved through initiatives like the Corporate Sustainability Reporting Directive (CSRD). "All of those are now under threat in the name of competitiveness," he warns.

Economic rationality of the ESG movement

When asked about the economic rationale behind the ESG backlash, Johnston is clear: "It doesn't make economic sense. The principles of ESG investing align not only with long-term prosperity but also with current market realities, such as the declining costs of renewable energy. Renewable energy is now largely cheaper than fossil fuel energy," he concludes, highlighting a transition that reflects both economic and environmental imperatives.

Joeri de Wilde echoes this sentiment but at the same time emphasises the importance of recognising the reporting burdens placed on asset managers committed to sustainable practices. "We may have seen too much reporting burden for the greenest asset managers," he notes, suggesting that a balance is necessary to ensure both accountability and progress.

The role of public sentiment

Despite the backlash, both Johnston and De Wilde remain optimistic about the future of ESG investing. De Wilde shares the findings from a survey conducted by Triodos Bank, which indicate that a significant majority of people still support transitions toward a greener, more inclusive economy. "More people are in favour of necessary transitions than against them," he said, suggesting that public sentiment may still favour sustainable practices.

Johnston emphasises the need to demystify ESG, linking it to the everyday lives and concerns of individuals. "If we can draw those links more strongly, we can emerge from this backlash even stronger," he asserts.

The outlook for sustainable investing

Concluding the discussion, both experts agree on the importance of resilience within the ESG movement. "The backlash is real, but it has not changed our mission at ShareAction," notes Johnston. Similarly, De Wilde affirms that the need for sustainable investing has never been more relevant, citing the current geopolitical climate and environmental challenges.

In the face of adversity, both Johnston and De Wilde encourage stakeholders in the sustainable investment community to remain vocal and steadfast in their commitments. "There's never been a greater need for responsible investment," Johnston concludes, reinforcing the belief that navigating this backlash could ultimately strengthen the ESG movement.

In summary, while the ESG backlash poses challenges, it also offers an opportunity for reflection and renewed commitment to sustainability principles. As public support for responsible investment remains strong, the path forward may require innovative approaches to engage broader audiences and align sustainable practices with economic realities.

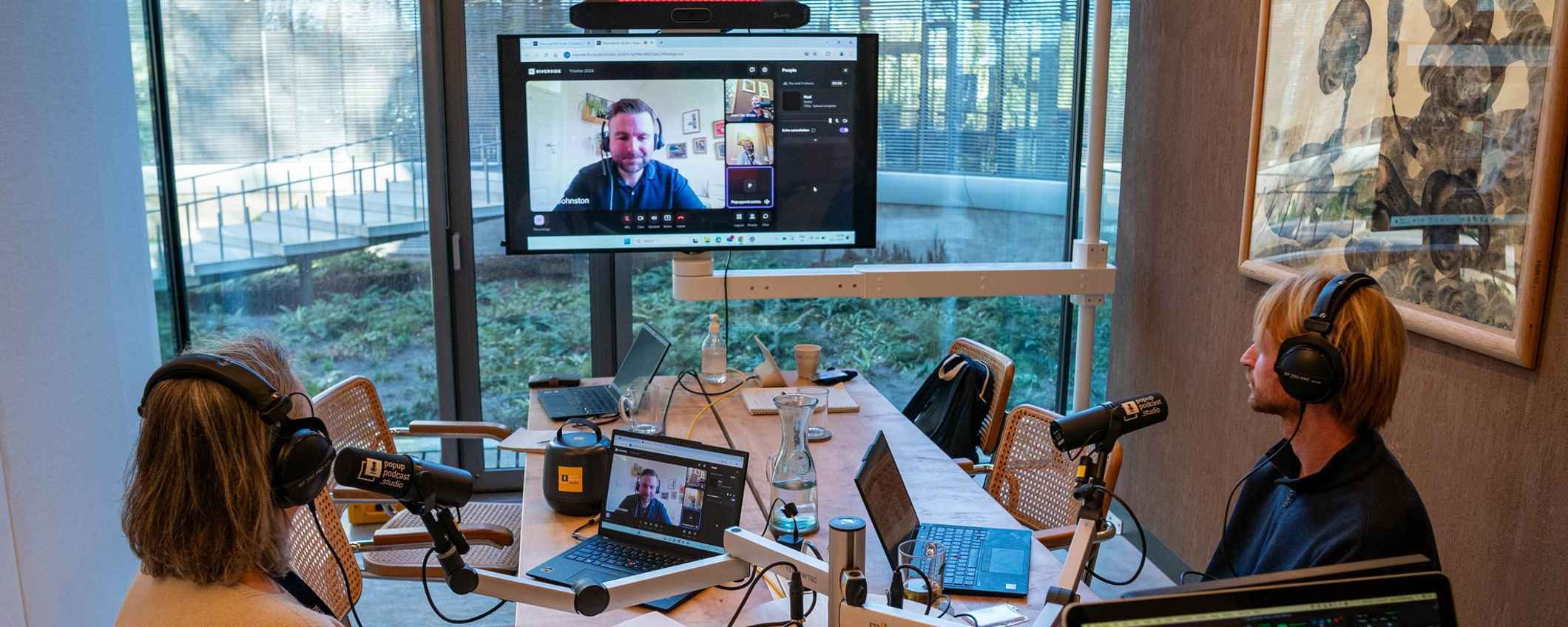

Listen to the podcast with Rosl Veltmeijer, Lewis Johnston and Joeri de Wilde.