The climate crisis reached a critical juncture in 2024, with global temperatures surpassing the 1.5°C threshold for the first time, signalling a strong warning about the accelerating pace of climate change. Greenhouse gas emissions continued to climb, reflecting the gap between climate pledges and tangible action from different stakeholders. This year also saw significant setbacks in global climate initiatives: key companies scaled back their targets, the Glasgow Financial Alliance for Net Zero (GFANZ), a financial association of investors, softened its ambitions, and major banks withdrew from climate coalitions. Furthermore, the increasing scrutiny on carbon offsets and the lack of substantial progress at the recent COP 29 summit further underscored the urgent need for effective climate strategies. In this critical landscape, investors have a vital role to play, by engaging companies not just to set targets, but to deliver real-world reductions and transparency.

Turning towards scope 3 emissions

Since 2020, our approach in the Impact Equities and Bond (IEB) portfolios has evolved from encouraging basic GHG reporting to driving comprehensive, science-based climate action. Initially, discussions focused on whether companies were reporting their scope 1 and 2 GHG emissions and setting reduction targets. Today, we challenge companies on data quality, the credibility of their strategies and their capacity to achieve net-zero goals - especially around the complex issue of scope 3 emissions.

This shift reflects a growing expectation for companies to provide transparent and detailed plans regarding their climate actions. While many companies have already picked the low-hanging fruit of emission reductions, such as transitioning to renewable electricity and reducing scope 1 emissions, the real challenge now lies in addressing the harder-to-abate scope 3 emissions. Tackling scope 3 emissions requires a comprehensive approach that goes beyond a company’s direct operations. It involves engaging with suppliers, customers and other stakeholders across the value chain to drive meaningful reductions.

We encourage companies to set science-based targets that include scope 3 emissions, develop actionable roadmaps and provide a transparent progress report. By focusing on these deeper, systemic changes, we aim to support companies in achieving substantial and sustainable emissions reductions that align with global climate goals.

Ongoing SBTi alignment

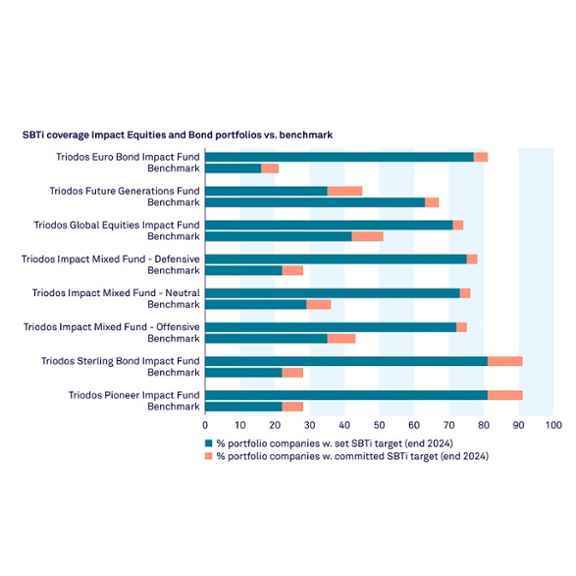

By the end of 2024, 63% of the net asset value in our IEB portfolios was aligned with Science-Based Targets initiative (SBTi) standards. While in the overall market some companies are stepping back from their targets, especially in the US, our funds continue to grow the rate of alignment. As the bar chart shows, nearly all our listed equity and bond holdings outperformed their respective benchmarks on setting science-based targets, underscoring our investment strategy of selecting companies with robust sustainability practices. We actively encourage companies to set targets consistent with SBTi guidelines, including rigorous treatment of scope 3 emissions. These frameworks not only provide consistency and comparability but also enhance investor confidence.

Engagement highlights

The dicsussions with three of our portfolio companies are exemplary for our engagement efforts in 2024.

Evonik Industries

A major specialty chemicals producer and a significant emitter, the company made a milestone move by shutting down its coal-fired power plant in Marl, Germany, in March 2024. Although delayed due to geopolitical disruptions - including the war in Ukraine - this step will materially cut its scope 1 emissions, as the plant represented over 24% of these emissions in 2023. We have consistently pushed for the decommissioning of their coal-fired plants.

Atlas Copco

A leading industrial company based in Sweden and one of the top five greenhouse gas emitters in our IEB portfolios, the company specialises in compressed air, vacuum technology, industrial tools, and construction equipment. We engaged with the company to discuss its sustainability targets for 2025-2027.

Signify

A global leader in smart lighting solutions, the company has already cut its absolute GHG emissions by over 50% since 2019 and aims for net-zero by 2040. Part of our IEB Pioneer Impact portfolio, Signify is one of our largest emitters when all its GHG emissions are accounted for.

From target setting to transparent and accountable action plans

Looking ahead, we know that climate change won’t stop and that the challenges will intensify, not only through temperature rises, but especially through extreme weather events and other concerning changes in our ecosystems. Climate physical risks are therefore a topic of growing importance in conversations with companies. We seek to understand what measures they have in place to mitigate these risks and drive transparency and accountability within companies’ reporting and sustainability strategies. We will focus on whether companies are actually meeting their targets that they have set in the past few years and whether Scope 3 emissions are under control. By fostering resilience and sustainable practices, we aim to ensure companies are well-prepared for a changing world while contributing to a more sustainable future.