The plastic waste crisis has reached a critical point, with oceans overflowing, ecosystems under severe strain and communities grappling with the fallout of plastics pollution. Recognising the urgency, we launched our plastics and packaging engagement project in 2023. We engage with 12 listed companies from the consumer staples sector to drive their progress on reducing plastic use. At the same time, the EU has adopted the Packaging and Packaging Waste Regulation (PPWR), which replaces outdated packaging rules, to tackle these challenges head-on. In this article, we share the latest update on our engagement efforts and their impact.

Our plastics and packaging engagement project targets key players in the consumer staples sector, focusing on 12 companies included in our Impact Equities and Bond portfolios. By conducting in-depth assessments and engaging directly with these companies, we’ve worked to evaluate their progress in reducing plastic use and promoting sustainability.

While investor engagement plays an important role in encouraging corporate responsibility, it has its limits, however. Regulatory changes like the EU Packaging and Packaging Waste Regulation (PPWR) are essential because they create enforceable standards, level the playing field across industries, and drive long-term, systemic change. We welcome these transformative measures, which provide the robust framework needed to tackle the plastic waste crisis at its core.

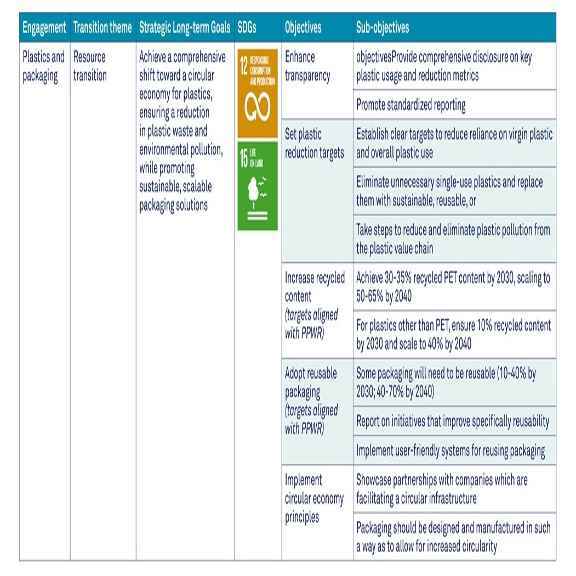

Project objectives

After the first round of engagements and assessments in 2023, we established a set of objectives serving as a pathway for our ongoing efforts. Several of these objectives align with the PPWR, and we have adopted the regulation’s definitions, such as those for recyclability. We expect most companies to align their definitions with PPWR standards and to begin disclosing the specific indicators outlined in the regulation. Currently, this is a challenge, as companies often report on different indicators or use varying definitions. Key differences in recyclability definitions among consumer staples companies lie in the standards they use (e.g., Ellen MacArthur Foundation, RecyClass or local regulations), their emphasis on potential versus practical recyclability and their focus on specific materials like food-grade plastics or packaging redesign.

Progress evaluation in sustainable packaging

After having engaged with 12 companies from the consumer staples industry, we identified Danone, Henkel and Procter & Gamble (P&G) as the companies in our portfolios with the most significant exposure to plastic pollution (see the article How Do Companies Deal with Plastic Pollution?). Our engagement with these companies focused on driving measurable outcomes in key areas: transparency and comparability of disclosure, plastic reduction, recycled content, reusable packaging and circular economy principles. Given their substantial plastic footprint, we assessed each of the three companies' progress toward adopting a more circular packaging model, aligned with the objectives outlined in table 1.

The following case studies showcase the outcomes of our engagement and the advancements each company has made in implementing sustainable packaging practices.

Danone

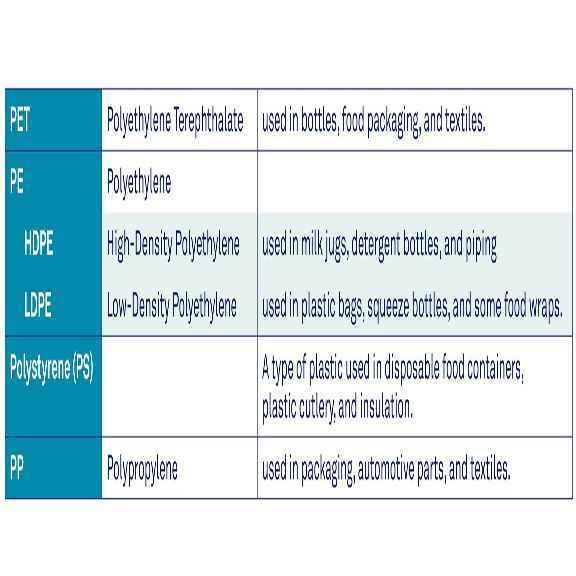

A global leader in dairy, food and water products, the company heavily relies on plastic packaging, primarily using PET, HDPE, PS, PP, and LDPE (see Table 2) for various product lines and transport. In its fiscal year (FY) 2023 Danone used 693,156 tonnes of plastic (FY 2022: 762,519 tons; FY 2021: 750,994 tons), hence the company has succeeded in lowering the absolute amount of plastics used, but also the year-on-year (yoy) intensity rate, which decreased by 9% (calculated as the change in reported plastics in tonnage per revenue, yoy). As a signatory of the 2018 Global Commitment on Plastics, Danone has committed to ambitious goals to reduce, reuse and recycle its plastic packaging.

Henkel

The company is a global manufacturer operating in two key business units: Adhesive Technologies and Consumer Brands. The company produces a range of products packaged in plastics, spanning both B2B and B2C markets. In 2023, Henkel used 281,485 tons of plastic (FY 2022: 306,222 tons; FY 2021: 304,420 tons). Thus, Henkel, too, has managed to lower the absolute amount of plastics used and managed to reduce the year-on-year intensity, which decreased by 9%. In line with its commitment to a circular economy, Henkel has adopted a three-pillar packaging strategy focused on sustainable design, material use and recycling.

Procter & Gamble

Procter & Gamble (P&G) is a US multinational consumer goods corporation. Its main product categories are laundry and cleaning, paper, beauty care, food and beverages, and health care segments. All these product categories underlie safety and hygiene requirements, so packaging plays a cardinal role in P&G’s activities. In 2023, P&G used 712,000 tons of plastic, mainly PE, PET and PP (FY 2022: 776,220 tons). P&G also managed to lower plastic usage, by 8% yoy, although part of that can be attributed to the 3% decline in units sold.

Conclusions

Our engagement with Danone, Henkel and P&G has revealed varying levels of progress toward sustainable packaging, with clear areas for improvement across all three companies.

Danone has made the most notable advancements in transparency, recycled content and reuse goals, showing alignment with circular economy principles. However, challenges persist, particularly with material scarcity and infrastructure limitations, which may hinder its ability to fully implement a sustainable packaging model.

Henkel has taken proactive steps in packaging redesign and setting recycled content targets, but greater transparency and measurable progress is required to demonstrate its commitment on a global scale.

P&G has increased its efforts toward recyclability and reusability, supported by partnerships to improve recycling infrastructure. While there are examples of initiatives to reduce and replace materials, further steps are needed to address scalability and consistency in implementation.

Overall, while each company is making progress, significant gaps remain, particularly in aligning actions with measurable outcomes and overcoming systemic barriers to sustainability. Another notable gap is the lack of consistent and comparable disclosures and definitions. The CSRD could potentially improve disclosure practices, making it worth considering for inclusion.

Regarding the requirements of the PPWR, we believe all three companies are on track to comply with the 2030 targets. Some objectives, such as the recycled content of plastic packaging other than PET, have already been achieved. However, the 2040 objectives are significantly more ambitious, and these companies will need to step up their efforts to meet the increased requirements.