Hazardous chemicals have been a key topic of our company engagement agenda since 2021. In a collaborative engagement effort we encourage chemical companies to phase out hazardous chemicals and transition toward more sustainable solutions. In 2024, the third round of engagement on this topic, we met with chemical companies Akzo Nobel, Evonik, and Shin-Etsu to discuss synthetic, highly toxic per- and polyfluoroalkyl substances, in short: PFAS. The three companies are part of our impact equities and bond portfolios.

In our previous articles Phasing Out Hazardous Chemicals (2022) and Phasing Out PFAS (2024), we outlined our approach to investing in chemical companies and shared notable engagement results.

Launch of the engagement season

Triodos Investment Management, alongside other investors, partners with ChemSec to promote safer chemical alternatives. The release of ChemScore, an annual report by ChemSec, marks the start of our engagement season. This report ranks the top 51 chemical producers on their efforts to reduce their chemical footprint and move towards sustainable practices.

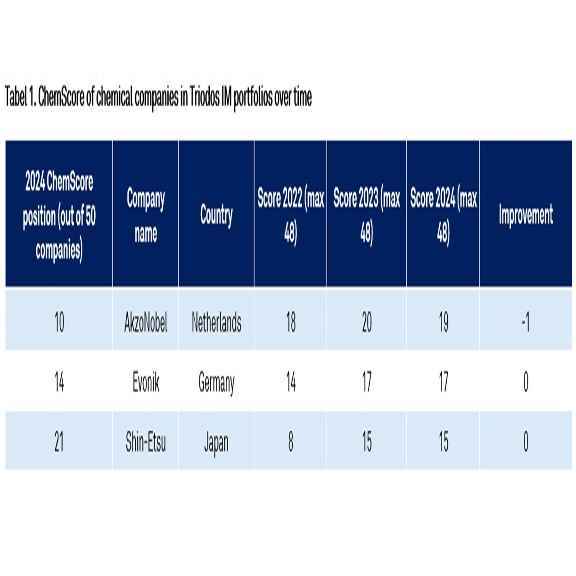

In 2024, the ChemScore results indicate minimal progress, with the three companies we engaged showing stagnation or slight declines. This contrasts with 2023, when all three made improvements, particularly Shin-Etsu, which saw significant gains (see Table 1).

The ultimate goal is to reduce the production and use of hazardous chemicals. While ChemScore shows transparency improvements among the 51 ranked companies, ChemSec reports minimal reductions in hazardous chemical production. Rather than signaling a trend break, these scores show that engagement requires time and persistence.

Engagement outcomes

Progressing towards a safer future: the path ahead

Hazardous chemicals are finally stepping into the spotlight, driven by new regulations like the EU's CSRD and stricter reporting from the US EPA. While we’re heading in the right direction, there’s still much work to be done. Currently, only a handful of PFAS substances are classified and regulated, but that’s set to change in the coming years. Companies must begin reporting on these chemicals now and prioritize the development of safer alternatives. This proactive approach will not only help them stay ahead of regulations but also position them as leaders in the industry, meeting the rising demand for sustainable products. Beyond environmental benefits, this shift can lead to significant financial gains, as highlighted in "A Profitable Detox – Why Safer Chemistry Makes Financial Sense."

Our discussions with Akzo Nobel, Evonik, and Shin-Etsu demonstrate that with patience and persistence, meaningful engagement can drive positive change in both sustainability and financial performance.