Small and medium-sized enterprises (SMEs) are often of no interest to mainstream banks, UsPlus' Ryan Cameron tells us during a video call: "Lending to these companies is often perceived as a lot of work with low potential returns. That's why banks prefer to work with larger companies." For entrepreneurs who as a result miss out on access to financial services, next-generation technology offers an alternative.

How exactly does that work? Ryan gives the example of a vegetable grower who offers his or her crop to a distributor. Until that distributor has paid the invoice, as a grower you need to have sufficient funds to cover your expenses. If you are a client of UsPlus, they will pay your invoice immediately and then start collecting the amount from the distributor. For that service, you pay UsPlus a percentage of the invoiced amount. As a result, you don't have to worry about paying your employees and you can start preparing for the new crop.

Without a loan

This way of working is called discounting. Since its launch in 2015, UsPlus has already advanced USD 188 million in this way. The benefits for SMEs are many: easy and quick access to working capital, no need to chase unpaid invoices and a better cash flow to pay their suppliers and build their business - all without a loan or monthly fixed costs.

This kind of service should not be necessary, says Florian Bankeman, fund manager at Triodos Investment Management. "But inequality is high in South Africa, starting a business and keeping it going is not easy. Especially when you know that it can sometimes take a year, particularly for larger companies, to pay their invoices. That is devastating for start-ups." On a working visit in February last year, he met a furniture maker with several dozen employees. "They were excited that they had just secured a big client. Which was possible because, thanks to UsPlus, they did not run the risk of having to advance money 12 months themselves."

Entrepreneur Thabiso, who runs a logistics company, summarises as follows: "There is a big difference between selling something and getting paid for it. As a business, you are nowhere without cashflow. Thanks to UsPlus, we now have a profit margin that supports many families."

Real people

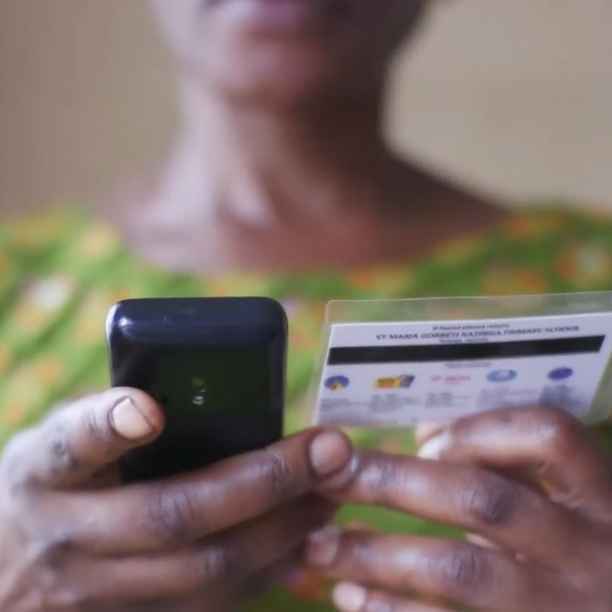

"Our clients include South African farmers, manufacturing companies, transport companies," Ryan says. "We work with real people and help them with the challenges they face. They are all companies that are valuable to our country. By working with us, they gain stability, can grow and hire more people."

Ryan cites the example of the film industry, where production houses are paid by film distributors the moment their film appears on the big or small screen. As a result, revenues come in gradually, while all costs have already been incurred by then. Making ends meet is a daily challenge. "One of the production houses we work with was about to throw in the towel. Today, their films are on Netflix, Amazon and Showmax, among others."

Florian added: "This way, South African filmmakers and their way of filming are given a platform. That too is making positive impact."

Exclusion criteria

UsPlus has customers in more than 40 sectors, including healthcare, sustainable agriculture and recycling. Businesses with clear added value for society. There are also sectors and activities they explicitly exclude because of their negative environmental or social impact, such as mining, tobacco or gambling. Their exclusion criteria are based on the International Finance Corporation Exclusion List.

"UsPlus has a proven track record of performance and resilience over the past eight years. The investment by Triodos Fair Share Fund and Triodos Microfinance Fund means this innovative fintech can scale up and diversify its funding base - further bolstering South Africa's underserved SME sector," conludes Florian.