The question is whether this positive sentiment will last long enough to create material shifts in funding flows, attracting private investors willing to provide a steady stream of capital to generate positive impact. It is certain that a major investment push is needed to deliver on both development and poverty reduction, while dealing with the growing impact of climate change and environmental degradation.

Emerging markets’ performance keeps surpassing expectations

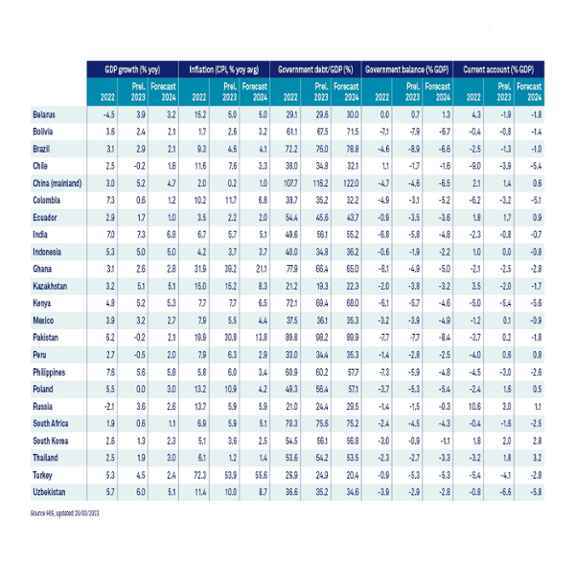

Emerging countries ended 2023 on a strong note and incoming data is pointing to continued resilience. GDP growth was around 4.1% on average in 2023, unchanged from 2022. Not even China’s uncertain growth path, triggered by persistent imbalances in the property market and weak consumer confidence, was a spoiler here. With targeted government support, China grew by 5.2% in 2023. Moreover, the uncertainty around China influenced investors’ preferences, moving some of their investments from China to other emerging economies.

Meanwhile, inflation in emerging markets stood at 8.4% at the end of 2023, down from 9.8% in 2022. China is one of the few countries that had to cope with deflation in the last quarter of 2023. In several emerging markets, the worst of price rises appears to be over. Colombia, Peru and Brazil, have even increased the pace of rate cuts this year. Other countries, including South Africa, the Philippines and India, have held back and are waiting for more signs that inflation will further abate.

Constructive outlook, despite loaded election calendar and geopolitical risks

Emerging markets’ growth is expected to remain steady in 2024 at around 4%. Recently released emerging economies’ manufacturing and services Purchasing Managers Index surveys, which focus on current and near-term economic expectations, mostly point to economic expansion in the coming months. The Chinese government recently announced a 5% growth target and 3% inflation for 2024, which means that more government support is in the pipeline.

Additionally, independent central banks in emerging economies that started rate hikes at an early stage of the inflation process are reaping the benefits of their credible monetary policy. Expectations across most emerging markets are that inflation will move steadily towards their common 2% target this year. Some exceptions include Argentina, Turkey, Nigeria, Ghana, Pakistan and Egypt where inflation remains high.

There is great concern about political developments ahead of a record number of elections to be held this year. But so far, the election results in Bangladesh, Honduras, Indonesia and Pakistan show continuity rather than major shifts in the political landscape. In other countries, including India and South Africa, the fear that upcoming elections would lead to excessive fiscal spending and growing government deficits has been mitigated by relatively conventional fiscal policies. Despite social pressure and the need to push for infrastructure development, India’s government has chosen for a conservative budget to reign debt, while South Africa, contemplates higher taxes to compensate for additional social spending in its budget proposal. As for geopolitical risks, these remain in the background. The wars in Gaza and Ukraine are having an enormous cost in human life, but the economic and financial spillover effects have been subdued. Financial markets remain balanced in their assessment of the regional spillover on this front.

Investor optimism increasing

For investors to shift their investments from advanced economies to emerging markets, the latter’s market prospects must clearly be more favourable than in advanced economies. There are some signs pointing in this direction. To begin with, the GDP growth differential between emerging markets and advanced economies has been increasing and if China can deliver on its growth target this positive gap will increase further.

Furthermore, the prospect of US rate cuts and a weaker US dollar means that emerging market currencies would be able to compensate investors with currency gains. They were negative over the past couple of years. US dollar weakness going forward will depend on the pace of slowdown of US growth. Finally, thirty-six emerging economies have an IMF programme, including Kenya, Costa Rica and Kazakhstan. This often serves as a catalyser for additional funding from capital markets and will likely support investors’ appetite for emerging markets going forward.

In general, emerging markets have done a good job in navigating the Fed’s high interest rates, but it will take more effort to attract long-term capital inflows. And we must also not forget that the differences across emerging markets are large. Countries with a relatively better macroeconomic performance and better-quality institutions can access capital markets at lower costs. Where these fall short, risk premium/spreads are high and access to capital markets limited.

And capital is strongly needed to carry out the necessary energy and food transitions to meet the climate goals, while trying to reduce poverty. The current amount should double to about USD 2 trillion annually by 2030. Private investors looking to balance financial and social returns do well to consider a role in financing these transitions in emerging markets.