In the recent floods in Pakistan, around 33 million people were affected. The most vulnerable lost their income and property and suffered from disease outbreaks. More than 8.5 million people ultimately fell below the poverty line. While Pakistan’s share in global greenhouse gas emissions is as little as 0.8%, because of its early development stage and its impact on global warming is even smaller. And as climate change continues to lead to more disasters, especially the poorer emerging economies with a small carbon footprint are desperate for funds to avoid the next calamity. At the same time, they need to transition to cleaner energy sources. It is uncertain, however, how far they can come given their colossal debts.

Emerging markets have become the ground zero of climate vulnerability. There is no doubt that mobilising capital to finance mitigation and adaptation to climate change is imperative. But the global scale of the energy transition demands that the choices of policies and investments in the clean energy space take social inclusiveness and income inequality into account (Shelton and Eakin, 2022, and IPCC’s Sixth Assessment Synthesis Report). Climate justice is a necessity and can only be achieved if everyone takes part. Above all, it should not come at the cost of unsustainable debts or surging inflation in the poorer countries (Morison 2021).

Undoubtedly, the renewable energy transition in emerging markets is gradually allowing a democratisation of energy through the decentralisation of production and distribution. This may render energy more affordable for households and companies, but the energy demand will continue to grow enormously. Particularly in low-income countries, given their stage of development and large energy deficits. These countries have limited resources and must also deal with health, poverty, food insecurity and the large disparities between rural and urban areas. In this context, an equitable energy transition must consider this unsatisfied demand, requiring a change in mindsets in how we deal with energy substitution, financing and debt. Also required are inclusive supply chains to allow a sustainable development path for the poorer countries.

Getting energy inclusiveness right

To effectively shift from fossil to renewable energy, we need to scale up clean energy sources and make them available and affordable for the poorest populations, while making the process socially inclusive.

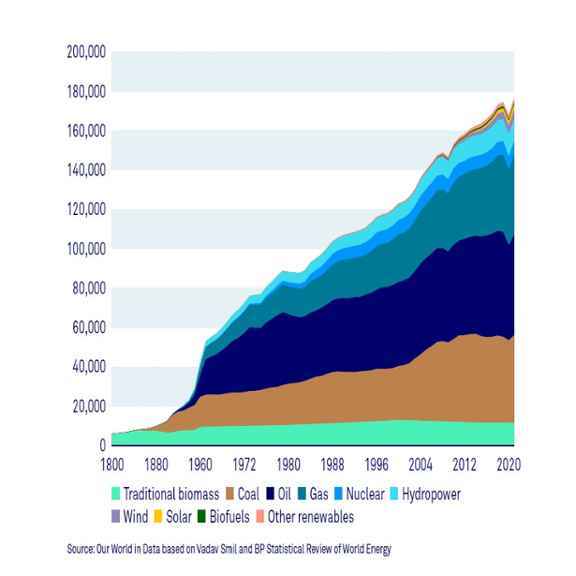

In the past, energy transitions have unfolded in extremely long periods and without having energy inclusion as a priority. Moreover, these transitions led to addition rather than to replacement (see graph), since there has been no effective decline in the use of the largest emitters of CO2, including coal and oil. In fact, since oil overtook coal as the world’s number one energy source, the global consumption of coal has almost tripled and not disappeared as one would have expected.

The rise of emerging markets and developing economies, particularly in the past few decades has led to an increase in the share of coal in final energy consumption. The demand for coal even increased in advanced economies during the recent energy crisis, despite the well-recognised health and environmental costs.

These difficult shifts suggest that energy transitions require broader inclusive development strategies than just switching to renewable energy sources. Indeed, no one should be left behind when satisfying potential demand and sustainability should be seriously embedded in equitable supply chains, finance, and the management of minerals.

Several inclusive development factors that are likely to determine the success of any energy transition:

- Satisfying energy demand

A large group of emerging countries has underdeveloped energy systems. Many sub-Saharan African countries can scarcely cope with today’s electricity demand and much less with expected future energy demand. This is where clean energy can make a difference. Energy is produced where it is consumed, allowing users such as companies and local communities to gain direct access at affordable prices. In the past couple of years wind and solar have become far cheaper per unit of energy than coal. In India, this has helped adjust the projected supply of coal from 80% to just 10% in the period 2018-2040. - Embedding sustainability in the investment process

Equality the production and distribution of renewable energy must be well guarded. It helps that impact investors are committed to following strict due diligence on environment, social and governance (ESG) criteria when financing renewable energy projects. A step further, as we do, is to perform detailed onsite environmental and social due diligence. For instance, by looking for those projects to finance that include community development programmes with gender-specific initiatives that target women in governance, as employees and as entrepreneurs, thus broadening the project beyond ‘just’ providing clean energy. - Equality in supply chains

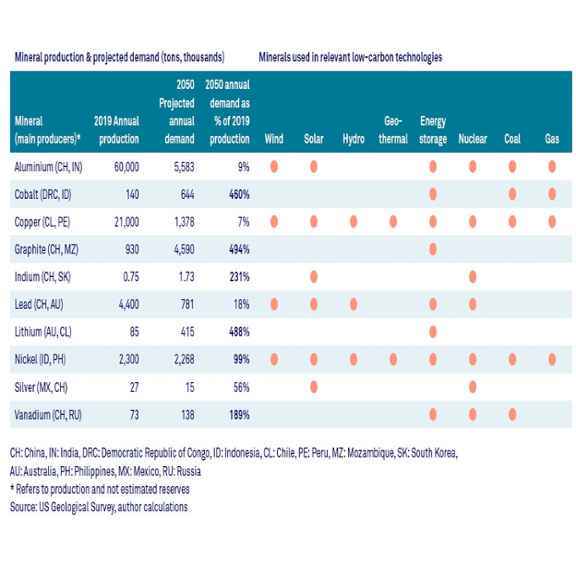

Given that the energy transition requires a large and steady supply of (rare earth) minerals, including copper, lithium and cobalt, the risk of supply falling short of demand is significant. Many of these minerals are largely provided by only few emerging markets (see table). As supply and demand are already diverging, the market increasingly works on a first-come-first-served basis. Without proper market regulation and coordination, the environmental, societal and economic impact of such a supply chain mechanism can cause more harm than good. Western countries financing mining activities or seeking to explore new markets (not only in Europe) would need to take the lead in creating standards for a fair global mineral market, which would reduce the increasing number of (potential) controversies about labour conditions. Ideally, other suppliers of minerals, including China and Russia should also take part, but this seems more unlikely given the current geopolitical fragmentation. Failing to create these standards can result in unfair competition and unsatisfied labour demands, leading to supply chain disruptions and scarcity. The upward pressure on the prices of these inputs is likely to affect particularly those countries that still need to harness any form of renewable energy.

- Management of windfall gains from mineral exports

At the same time, mineral-producing countries that are unable to manage the windfall gains of the mineral boom will likely face distortions in their economies, as experienced with past commodity booms. This, in turn, could hinder the overall energy transition. Indeed, mineral producing/exporting countries should think about spending their revenues and resources based on long-term sustainability goals. The Democratic Republic of Congo (DRC) provides almost three-quarters of global cobalt supply and 95% of its goods export revenues come from mining. Chinese companies are the dominant investors in the Congolese mining sector. This partnership has raised concerns about the environmental, social and governance impact of these mining projects, as well as the stability of supply chains going forward, and price volatility. Additionally, the DRC’s fiscal framework is not yet prepared to support the distributional impact of these windfall gains in good times. - Steering with social intentions

Finally, the energy transition in several fossil-fuel producing emerging countries involves shifting from these activities to the nascent renewable energy activities. This means they would lose an important source of public revenues, but also employment in the sector and related activities. If the energy transition is not organised properly, the loss of employment in the fossil energy sector could easily lead to social unrest. To avoid this, careful mapping of labour that will become redundant and of the type of skills and workers needed in the new situation is required. Timing is critical, as evidence shows that a declining fossil energy sector means that the renewable energy industry has to grow at an even faster pace to limit the social impact. If we can steer properly on these issues, the energy transition would also stimulate social inclusiveness and development.

Getting financing right

A global financing framework for poorer countries is needed to spread risks across investors and liberate capital in emerging markets to invest in renewable energy projects. This would strengthen the transition strategy, particularly in a challenging, high-interest rate environment.

Scaling-up capital for renewable energy projects is essential as financing sources are still limited. Support from advanced economies’ governments in particular is lagging, with only a small fraction invested in emerging economies and even a smaller fraction going to renewable energy, compared to climate mitigating projects. Emerging markets, excluding China, currently account for only one-third of global energy investment and an even smaller 20% share of clean energy investment. And the more than 750 million people lacking access to electricity because they are in or close to poverty barely have any access to funding.

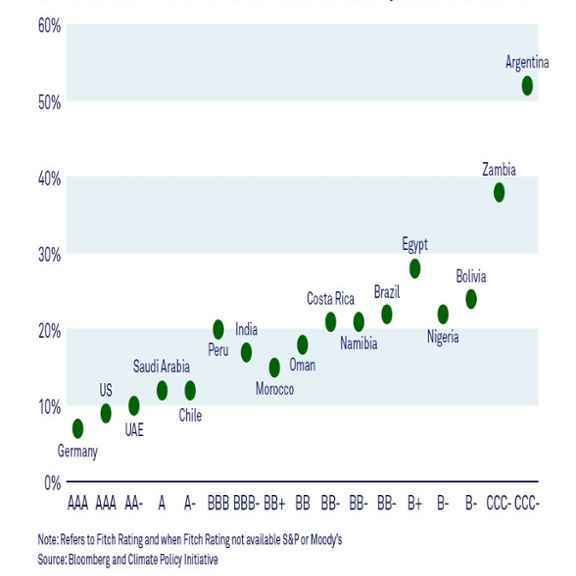

One of the bottlenecks to external private financing are the high returns (risk premium) required by investors to compensate for the risks of investing in a country with a challenging macro environment and weak institutions. These countries have already high debt-to-GDP levels and constrained budgets, and now with rising interest rates, the cost of funding has risen considerably. As a result, nominal financing costs in some emerging markets are up to five times above those in the United States and Europe, which reflects the risks captured by weak credit ratings (see graph).

As such, the financial architecture for renewable energy needs to be approached with a different mindset. We need to do more to incorporate the social cost of carbon emissions and the social benefits of renewable energy when making private investment decisions based on a comprehensive risk-reward profile. For impact investors, displaying the benefits of low-carbon investments, in terms of impact goals and the increase in social welfare, can make investing in such projects more attractive.

We can no longer afford that climate shocks and debt continue to feed one another in a ferocious downward spiral, affecting a large part of the world. To take all countries on board, the energy transition must be global and not country-by-country, considering the stage of development of each country and making use of standards to benchmark the world on what is needed. If we want this to be a permanent shift in energy sources that are better for the planet and inclusive for the poorer countries, this is the way to go.