After the 2008 financial crisis it was decided that this should not be allowed to ever happen again. An avalanche of research ensued. How economists could have got it so wrong, among other things. The lessons learned from the study of complex systems were applied to the financial sector. This led to the unanimous conclusion that there are systemic risks, tipping points and dangerous feedback loops within the financial system that can suddenly cause a crash. But all the writing and all the talk did not produce much action. Admittedly, bank buffers were raised, more regulation introduced, and risk oversight became stricter, but the system itself remained as it was. Spreadsheets to manage single risks. Nice and orderly.

The events of recent weeks prove that systemic risks have not gone away. First, we had the shock in the US, where Silicon Valley once again demonstrated that technology can accelerate everything, including a bank run. And then Switzerland, where a problem that had been dragging on for years at an oversized bank culminated in a forced takeover, making systemic problems in the longer run even larger. The reason why these systemic problems did not erupt earlier, is that they were covered by a veil of liquidity.

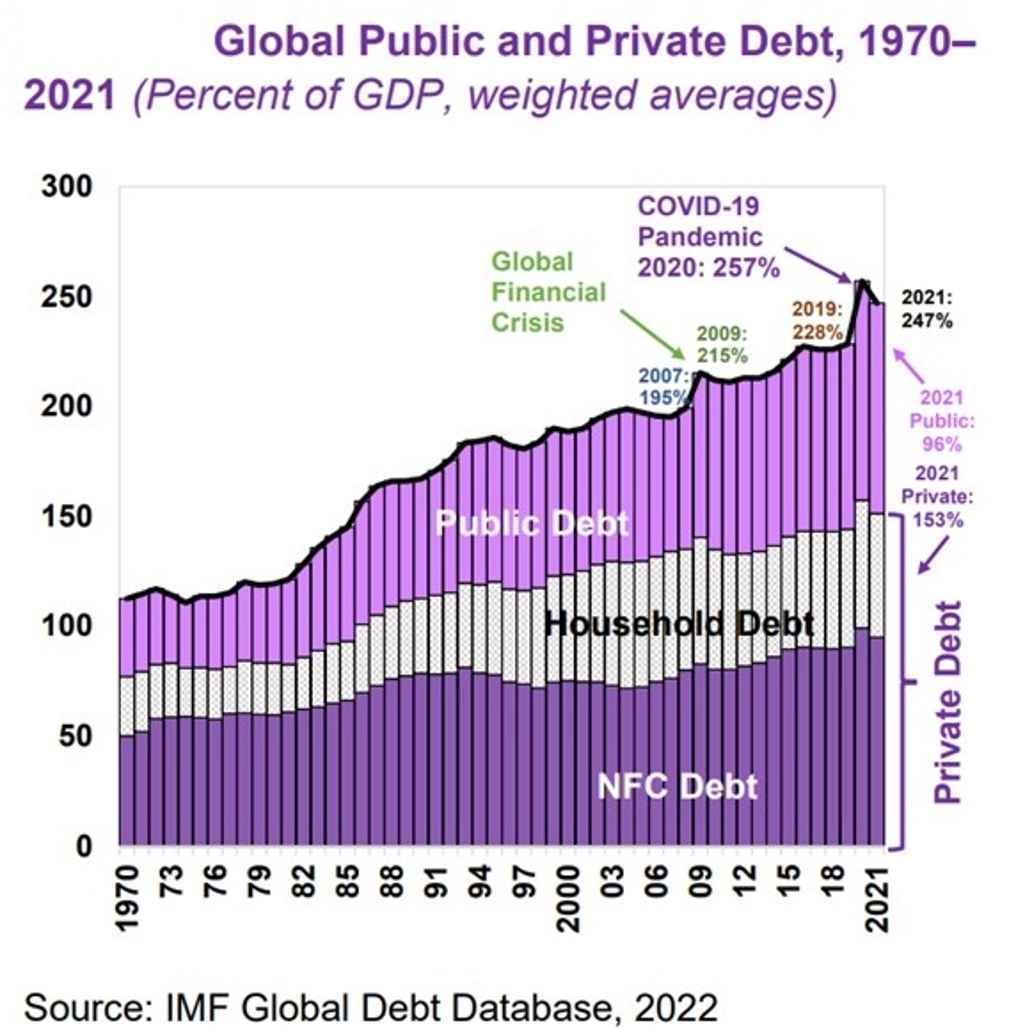

In fact, I believe that the systemic risks have only increased. In many countries, the big players have only become bigger. This applies to banks as well as to asset managers. In most countries the concentration ratio in the banking sector increased, induced by technology that creates economies of scale for large money flows. Furthermore, the supervision, especially in the banking sector, has led to extensive monoculture: standardisation and tighter regulations made control easier but diminished diversity. The negative feedback loops in the system are also making themselves felt more quickly. This was demonstrated by the twitter bank run on Silicon Valley Bank, but we also see it in financial markets in general. Panic can spread faster, leading to a larger chance on crashes. Meanwhile, the financial sector is having to contend with a considerably higher level of debt than in 2008: around two and a half times global GDP, versus two times GDP then. Can you imagine? 15 years after a global debt crisis you end up with more debt?

You don’t fight complexity by leaving the system as it is and believing that regulating is enough. Even more so, you don’t fight complexity by adding complexity, so more regulation will not work. If you compare the financial sector with nature, as was done in an article back in 2008, you will quickly see why. You want to prevent one dominant species from developing, because that would make the system increasingly vulnerable due to monoculture and diminishing diversity and by putting an extreme burden on the system.

So you ensure diversity and try to reduce the dominance of a handful of species, in order to prevent the whole system from collapsing if one species or element is knocked out. And what you want to prevent most of all is problematic elements from holding the whole system hostage. We did not do any of this. Lobbying, forgetfulness and not enough guts. It won’t be any different this time. Everything is the same as it was before.

This is a translation of Hans Stegeman's column in Het Financieele Dagblad, published 21 March 2023.