Our view on excessive remuneration

Excessive executive remuneration contributes to a widening pay gap between CEOs and average workers and is a key driver of rising inequality. Compensation packages are often structured around increasing shareholder return, and moreover, executive remuneration plans are often complex and untransparent. Triodos IM’s responsibility as an impact investor is to encourage balanced and fair remuneration policies and practices, limiting excessive CEO remuneration and reducing the pay gap in listed companies. We do so by excluding companies with the most excessive and inherently unequal remuneration systems, by engaging with companies on this topic and by our proxy voting. In 2021, we voted in favour of companies’ remuneration packages only in 21% of all instances. In our recently published white paper ‘Enough is enough – Responsible reward for sustainable leadership’ we explain our stance on CEO remuneration in detail.

What do we do about it

In 2021, we started a dedicated engagement project, focusing on companies with the most excessive and inequal remuneration systems in our equity portfolios. The long-term goal of this project is to encourage companies to reduce the pay gap between CEOs and employees while increasing the fairness, simplicity and transparency of remuneration packages. One way to achieve this is to (better) align executive pay schemes with their strategic drivers of long-term value rather than short-term financial success.

To this end we pursue an ongoing discussion with companies to understand their current remuneration practices, to share our remuneration principles, and to provide feedback on what we would like to see improved. As a first step we identified those companies with excessive remuneration.

How do we go about it

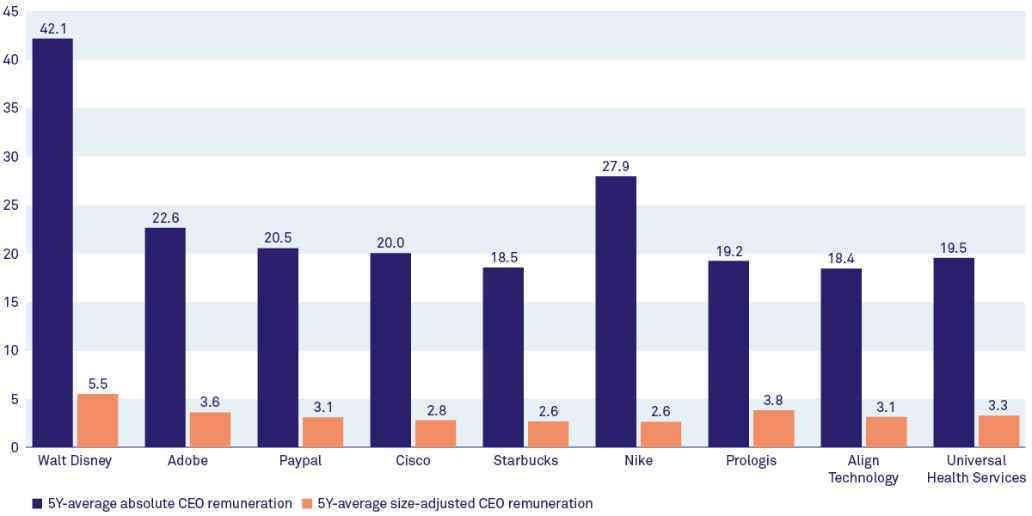

In total we identified nine companies with excessive remuneration, based on two criteria:

- Size-adjusted remuneration - the annual total CEO compensation over the last five years exceeds EUR 2.5 million on a size-adjusted basis (custom Triodos method). This size correction factor considers the market capitalization, revenues and number of employees in the company. For example, a company with a market cap of EUR 12 billion (factor 6), EUR 8 billion in revenues (factor 5) and 4,000 employees (factor 4) has an overall size correction factor of 5. This means that we would deem CEO remuneration to be excessive if in the last 5 years it amounted to more than EUR 12.5 million per year on average.

- CEO-to-median-employee pay ratio - the 5-year average CEO remuneration compared to the median employee compensation exceeds 100:1.

The nine identified companies are all from the United States. This is not surprising, given that the size of executive remuneration is often notoriously high in this country. Figures 1 and 2 show the companies and their scores on both criteria.

Next, we analysed the remuneration packages of these nine companies, using a framework of remuneration best practices. Table 1 shows our remuneration principles:

Based on the results from our in-depth analysis, we divested from Align Technology, whereas prospect company Universal Health Services was considered unsuitable for investment.

Engagement highlights

Of the seven remaining companies we approached for engagement, six were willing to discuss best practices and our views on remuneration: Adobe, Cisco, Nike, Prologis, Starbucks, and Walt Disney. Only PayPal did not respond to our engagement request. We will continue trying to get in touch with them.

In general, Triodos’ view and engagement on executive remuneration was appreciated by the companies. Their response and openness to discuss executive remuneration exceeded our expectations. We provided targeted feedback on points of improvement for the executive remuneration structure and asked for specific plans for improvement.

Common themes we discussed with all companies included transparency and disclosure in the proxy statement, as well as the inclusion of appropriate ESG and financial metrics in the remuneration plans.

Engagement highlight 1 - Starbucks

Of the companies we engage with, Starbucks has by far the largest gap between CEO and median employee remuneration. In 2021, when the total compensation of former CEO Kevin Johnson rose by 39% from USD 14.67 million to USD 20.43 million, the gap has further increased. This led to a rare rebuke at Starbucks’ 2021 AGM, where its advisory say-on-pay resolution was rejected by 53% of the votes cast (including ours). One of the main concerns expressed by Triodos and other shareholders referred to the granting of special awards to executives, particularly referring to the retention plan approved in December 2019. With a maximum pay-out of up to USD 50 million on an all-cash basis, we believe this award was excessive. We also deemed the frequency of one-time awards a concern, as the USD 50 million bonus followed a USD 5 million retention grant during the previous fiscal year.

In September 2021, we discussed the improvement of the company’s executive compensation structure both through financial and ESG metrics with members of Starbucks’ compensation committee and corporate governance and investor relations teams. Starbucks expressed its commitment to linking executive pay to diversity, which is positive. Other important topics discussed were disclosure and transparency in the proxy statement, grants of special awards, and the inclusion of performance metrics that in our view better capture the drivers of the business, such as FCF and ROIC. Starbucks appreciated our suggestions and expressed willingness to improve on these aspects going forward.

In its 2022 proxy statement Starbucks has included a section on shareholder engagement, in which the company confirms that it does not intend to make future special awards to executives or grant future multi-year performance awards in the form of cash. They have also enhanced disclosure around the achievement of the 2021 annual incentive awards and included ESG metrics. These new metrics are in line with Starbucks’ goals to halve its water use, carbon emissions, and waste from its operations by 2030, and grow their plant-based alternatives and collaborate with farmers to scale an approach to sustainable dairy. The inclusion of such metrics in its executive remuneration plan is a clear indication of Starbucks’ commitment to its sustainability transformation.

Engagement highlight 2 – Cisco and Nike

Besides Starbucks, we are pleased to see that Cisco and Nike have now also included ESG metrics in their remuneration plans after we spoke to these companies. With these new metrics, Cisco and Nike both focus on inclusion and diversity.

Cisco has included an ESG metric in its short-term incentive plan (STIP), which determines the annual bonus. Executive remuneration is now partly based on the CEO’s efforts towards providing an inclusive, safe, and healthy work environment, as part of Cisco’s 'Conscious Culture’ program. This metric is included in the CEO’s individual performance factor (IPF) scorecard.

Nike has integrated an ESG metric in its long-term incentive plan (LTIP), which we think is even better as we really view ESG as a long-term value driver. This new metric acts as a modifier, enabling up- or downward adjustment of performance-based pay by up to 20 percentage points. This ESG metric is based on an assessment of the company's performance with respect to employee engagement and inclusion, leadership diversity, and sustainability. It specifically considers Nike’s progress towards its 5-year Purpose targets, described in its 2021 Impact Report. These include increasing the representation of women and racial and ethnic minorities, operating more sustainably with respect to carbon, waste, water and chemicals, and improving responsible manufacturing in its supply chain. As we also engage with Nike on the payment of living wages in its supply chain, it is positive that CEO pay is now also partly tied to this topic.

While we applaud the inclusion of ESG metrics by Cisco and Nike, there are still improvements to be made. The next step would be to make the ESG metrics more quantifiable so that there is less discretion in determining CEO pay-out based on these ESG indicators. We will therefore continue to engage on this topic with Cisco and Nike.

Continued monitoring

The starting date of our executive remuneration engagement project in 2021 is our baseline for progress measurement. We will continue to monitor the pay levels and pay gap, as well as evaluate the compensation structure against the set principles. We will continue our engagement with the targeted companies on a yearly basis and will vote against remuneration arrangements that do not meet our standards. In the fourth quarter of 2022 we will have our second round of conversations with the companies in our engagement program. Besides the seven companies it currently includes some new companies that have come to exceed our thresholds in 2022 will now also be added to our engagement program.

While it is highly unlikely that companies will reduce the level of executive pay solely because of our engagement efforts, our active involvement may well contribute to sustained momentum in this direction. Regarding transparency and the inclusion of ESG metrics in compensation plans we have already seen several positive developments. Lack of progress could ultimately lead to divestment.

Enough is enough

Download our white paper and find out how to curb excessive CEO remuneration and reducing the income spread in listed companies.