Key takeaways from the PAIF Report 2021 include:

- a market size of nearly USD 40 billion;

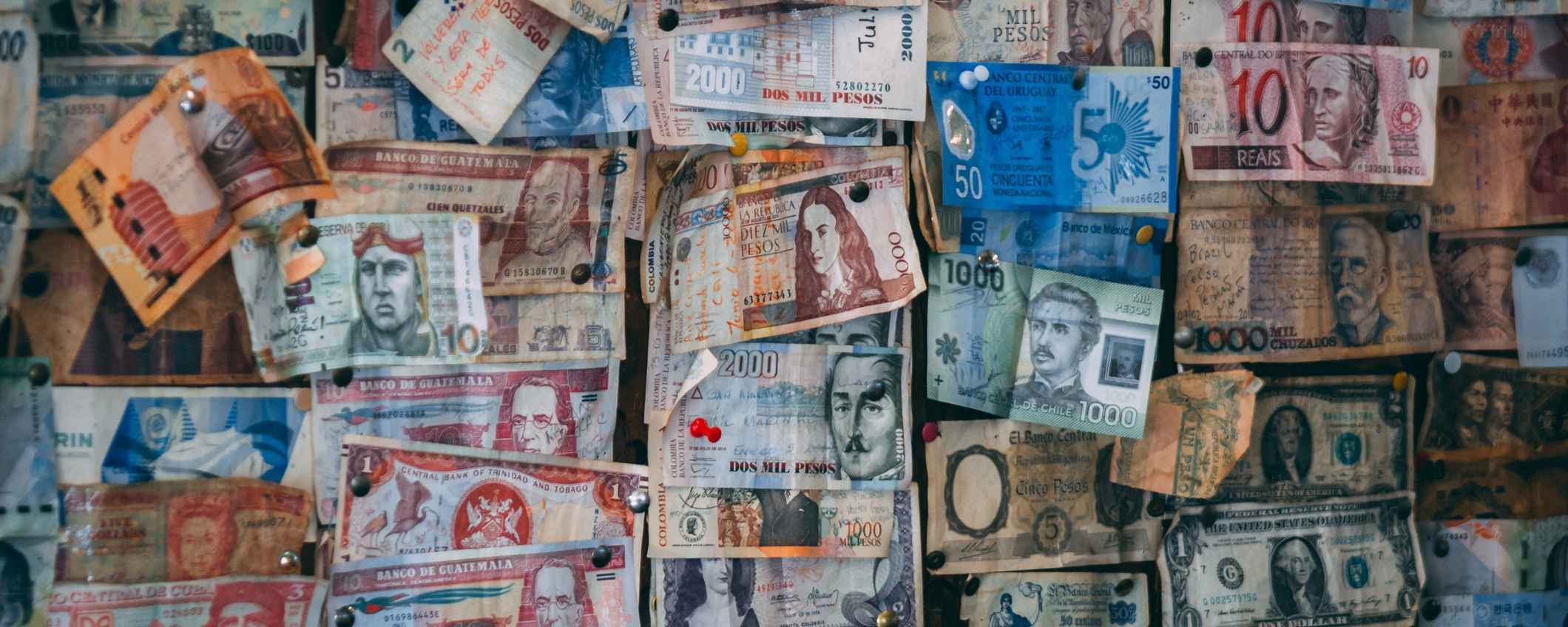

- the surveyed funds invest in over 120 countries, with Latin America & the Caribbean as the prime destination;

- microfinance remains the most attended sector;

- in 2020, performance was impacted by COVID-19 and COVID-19 related measures, resulting in flat growth and increased but still modest provisioning levels;

- forecasts show the resilience of the sector with reduced provisioning levels, double-digit growth and increased profitability foreseen for 2021, and

- private institutional investors are the source of more than half of funds’ investor money.

Triodos IM is among the leading impact fund managers who sponsored this research publication and contributed to the content with the aim to stimulate transparency and cooperation within the impact investing sector.

Frank Streppel, Head of Global Investments at Triodos IM: “Impact studies and market research, such as the PAIF Report, are essential to understand our markets and the needs of the beneficiaries of our investments. It provides an important basis to facilitate access to finance to support social and economic development in developing and emerging markets. The profound impact of COVID-19 makes this more relevant than ever before.”

You can download the report on the website of Tameo.

Learn more about our impact strategies.